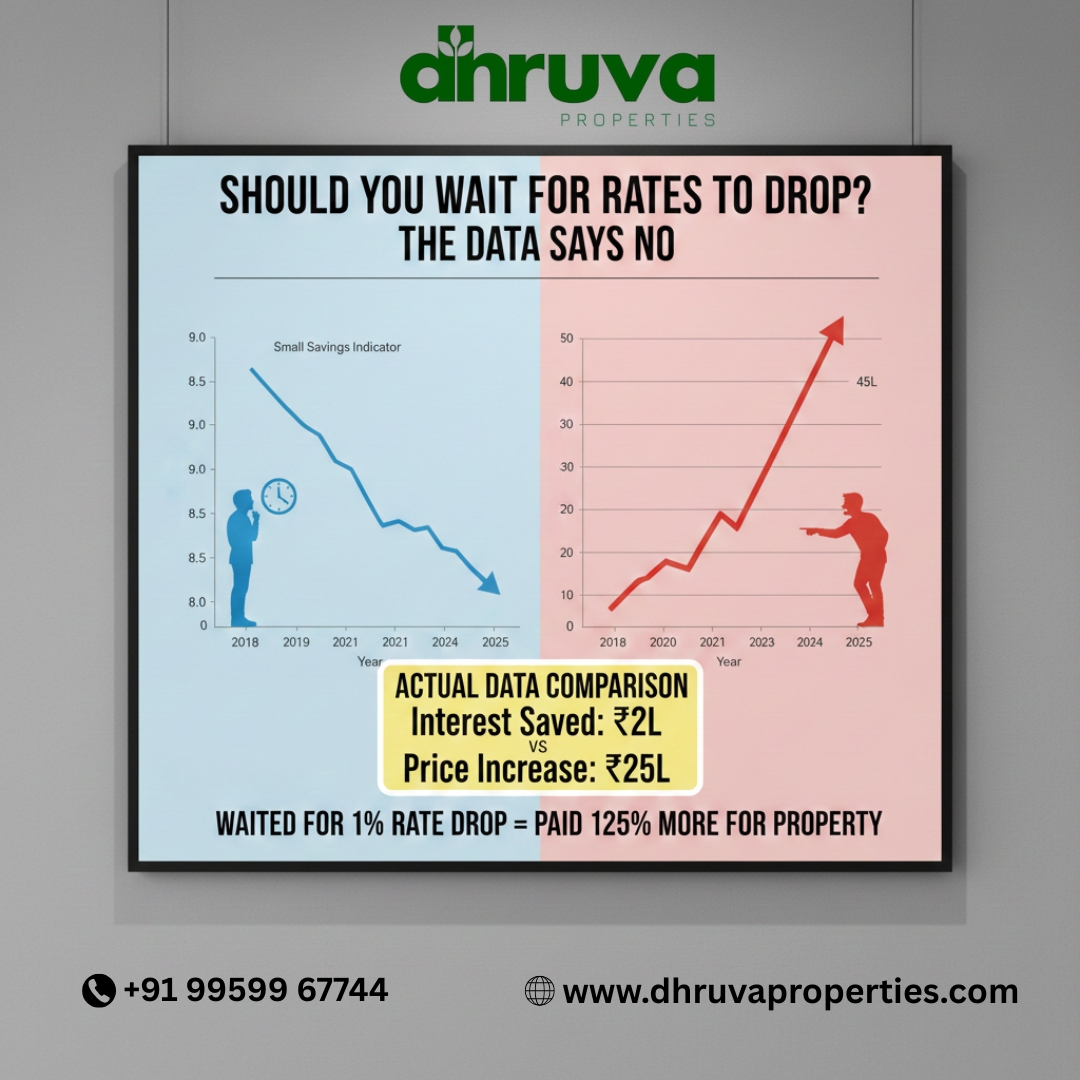

Should you buy property now or wait for rates to drop? What the data actually shows | Dhruva Properties 2025 Brief

When Rates Drop, Prices Rise—You Don't Actually Save

What everyone thinks: "High rates now. Wait for rates to drop. Then buy cheaper with lower EMI."

What the data shows: When interest rates drop, property prices spike immediately. You save on EMI but pay way more for the property itself.

Real example from data:

2010-2012: Rates dropped from 10% to 8%

- Gauribidanur-type areas: Prices jumped 30-40%

- "Savings" from lower rate? Lost to higher property cost

- People who waited paid more overall

2020-2021: Rates dropped during COVID

- Bangalore outskirts: Prices increased 25-35% when rates fell

- Buyers who waited for rate drop paid significantly more for same property

The math nobody tells you:

Scenario A - Buy now at high rates: ₹25 lakh property at 9.5% rate = Higher EMI, but locked at ₹25L price

Scenario B - Wait for rate drop: Same property now ₹32 lakhs at 8% rate = Lower EMI percentage, but 30% higher base price

You're not saving. You're just shifting where the money goes—from interest to principal.

And property price increase is permanent. Interest rates? You can always refinance when they drop.

What the data actually shows: People who buy during high-rate periods and refinance later pay less total than people who wait for rates to drop and buy at inflated prices.

"Waiting for Rates to Drop" Has Cost People Years of Appreciation

The waiting trap in data:

Tracked buyers from 2018-2025. Those who "waited for better rates" missed massive appreciation.

2018 scenario:

- Interest rate: 9.5% (people said "too high, wait")

- Gauribidanur land: ₹15-20 lakhs

- People waited for rates to improve

2025 reality:

- Interest rate: 8.5-9% (barely better)

- Same Gauribidanur land: ₹35-45 lakhs

- People who waited now can't afford the same property

The opportunity cost:

Buy at ₹20 lakhs in 2018 at 9.5% rate = Own ₹45 lakh asset by 2025 (even with higher interest paid)

Wait for better rates till 2025 = Now need ₹45 lakhs to buy what cost ₹20 lakhs before

The data is brutal: Seven years of waiting for 1% rate improvement = Lost ₹25 lakhs in property appreciation.

Interest rates vs property prices over 20 years:

- Interest rates fluctuate 1-2% up or down

- Property prices in developing areas: Consistently up 10-20% annually

- Waiting for rate drops = Missing appreciation that far exceeds interest savings

The pattern repeats: Every buyer who waited for "better rates" in data set ended up paying more overall or getting priced out completely.

Higher Rates Actually Mean Less Competition and Better Deals

Data nobody talks about:

High interest rate periods = Fewer buyers = Better negotiation power = Better deals.

What happened in high-rate periods (2011-2013, 2018-2019, 2022-2023):

- Buyer traffic dropped 30-40%

- Sellers became more flexible on pricing

- Inventory stayed longer on market

- Negotiation leverage shifted to buyers

Real impact in areas like Gauribidanur:

High rate period: ₹25 lakh listed property negotiated down to ₹22 lakhs because fewer buyers competing

Low rate period: Same ₹25 lakh property now ₹30 lakhs with multiple offers, zero negotiation room

You "save" on rates but lose more on inflated purchase price.

The data pattern:

- High rates = Buyer's market (better property prices, negotiable terms)

- Low rates = Seller's market (inflated prices, bidding wars, no flexibility)

Smart buyers in the data: Bought during high-rate periods when competition was low, refinanced when rates dropped later. Got best property price AND eventually got lower rates too.

Waiting for rate drops means: Competing with everyone else who also waited. Paying premium prices in crowded market. Zero negotiation power.

You Can Refinance Rates, You Can't Renegotiate Property Price

The most important data insight:

Interest rates are temporary and changeable. Property purchase price is permanent.

What's actually flexible:

- Interest rates: Can refinance when they drop

- EMI: Can be reduced through refinancing

- Loan terms: Can be renegotiated

What's locked forever:

- Property purchase price: Whatever you pay is final

- Appreciation: Based on your purchase price

- Equity: Built on your locked-in property value

Real scenario from data:

Buyer who waited:

- Bought property at ₹35 lakhs when rates dropped to 8%

- "Saved" on interest rate

- Stuck with ₹35 lakh purchase price forever

- Future appreciation on ₹35L base

Buyer who acted:

- Bought same property at ₹25 lakhs when rates were 9.5%

- Refinanced to 8% when rates dropped

- Now has ₹25 lakh purchase price locked

- Future appreciation on ₹25L base (₹10L advantage)

- Same current rate as person who waited

The winner is obvious: Lower purchase price with refinanced rate beats higher purchase price with "better" initial rate.

What data shows about Gauribidanur and similar areas:

- Property prices rise 15-20% annually

- Interest rates fluctuate 1-2% up/down

- Missing one year of appreciation costs more than entire interest rate difference

- Buyers who locked lower property prices (even at high rates) built more wealth

The strategy data supports: Buy at best property price available (now), refinance when rates improve (later). Not: Wait for rates, pay inflated prices, get stuck.