Understanding Capital Gains Tax on Residential Land Sales: Short-Term vs. Long-Term Implications

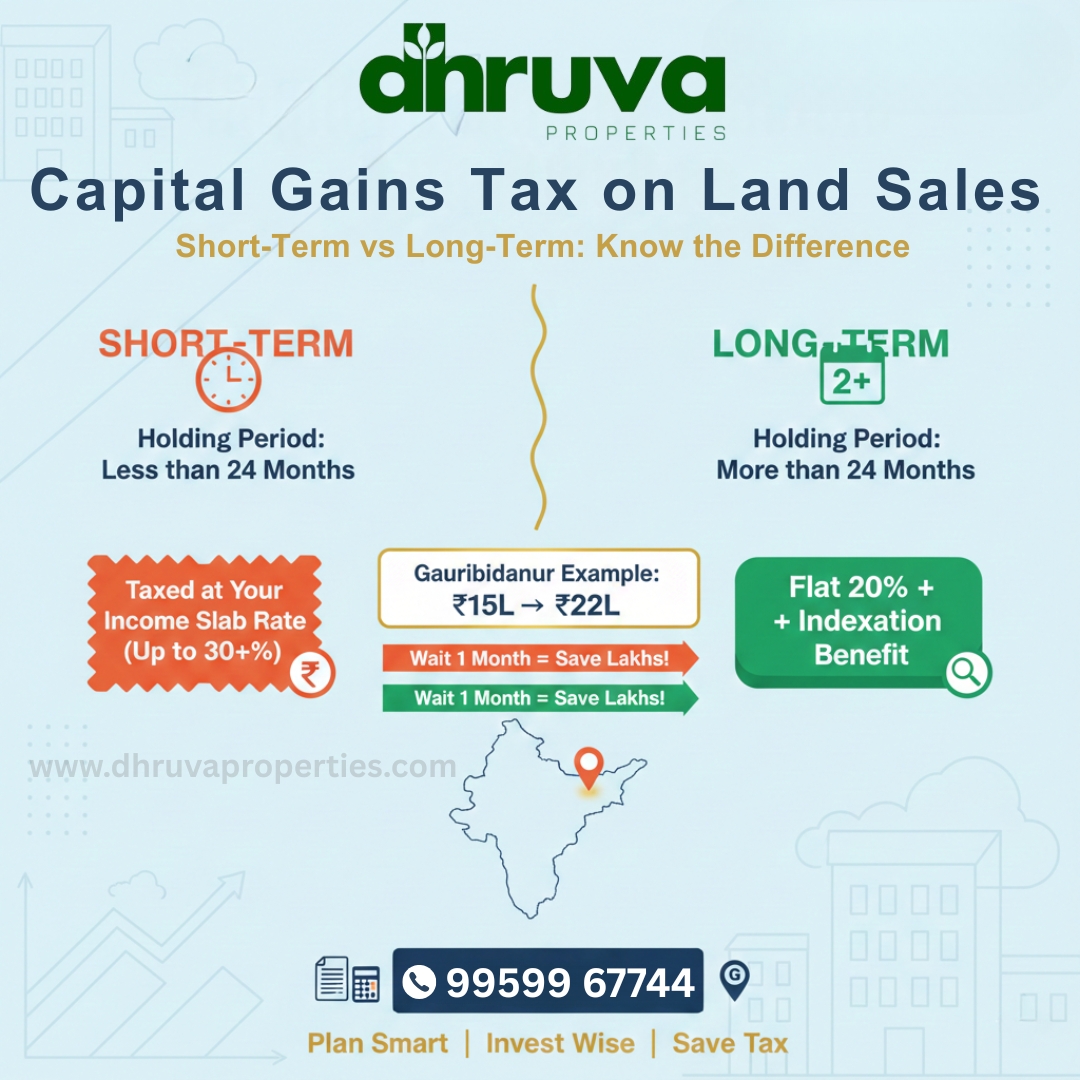

1. What Determines Short-Term vs. Long-Term Capital Gains?

The holding period of your residential land is the key factor that determines your tax rate. In India, if you sell land within 24 months (2 years) of purchase, it's classified as Short-Term Capital Gains (STCG). Any sale after 24 months falls under Long-Term Capital Gains (LTCG).

Gauribidanur Example: Rajesh purchased a 30x40 plot in Gauribidanur near the BIAAPA region in January 2023 for ₹15 lakhs. If he sells it in December 2024 (23 months later) for ₹22 lakhs, his ₹7 lakh profit will be taxed as short-term capital gains at his applicable income tax slab rate (potentially 30% or more). However, if Rajesh waits just one more month and sells in February 2025, the same profit becomes long-term capital gains, taxed at a flat 20% with indexation benefits.

2. Tax Rates and Calculations: The Real Difference

Short-Term Capital Gains (STCG): Added to your regular income and taxed according to your income tax slab (ranging from 5% to 30% plus cess).

Long-Term Capital Gains (LTCG): Taxed at 20% with indexation benefit, which adjusts the purchase price for inflation, reducing your taxable profit.

Real Scenario from Gauribidanur: Priya bought agricultural land converted to residential plots in Gauribidanur's upcoming zones for ₹25 lakhs in 2021. She sold it in 2024 for ₹40 lakhs. Her actual profit is ₹15 lakhs, but with indexation (Cost Inflation Index adjustment), her indexed cost becomes approximately ₹28 lakhs. Now her taxable LTCG is only ₹12 lakhs, and tax at 20% = ₹2.4 lakhs. Without LTCG benefits, she would've paid much more based on her income slab.

3. Strategic Planning: Timing Your Sale

The holding period isn't just about tax rates—it's about smart financial planning. Gauribidanur's real estate has seen consistent appreciation due to its proximity to Bangalore, improved infrastructure, and STRR (Satellite Town Ring Road) development plans.

Key Considerations:

- Market Timing: Gauribidanur's land values have appreciated 40-60% in the past 3-4 years in prime locations

- Tax Savings: Waiting to cross the 24-month mark can save you 10-15% in taxes

- Exemptions Available: Under Section 54F, LTCG can be exempted if you invest in a residential house property

Local Insight: Many investors in Gauribidanur's Dabaspet Road and Nandi Hills vicinity are holding properties for longer periods, benefiting from both appreciation and favorable LTCG tax treatment.

4. Documentation and Compliance

Proper documentation is essential regardless of your holding period. For land sales in Gauribidanur, ensure you have:

- Original sale deed and purchase agreement

- Khata certificates and property tax receipts

- Survey numbers and layout approval documents

- Bank statements showing payment trails

- Capital gains calculation statements

Important Note: Since Gauribidanur falls under Chikkaballapur district's jurisdiction, ensure all local body approvals (Gram Panchayat/Municipality) are in order before sale to avoid complications during tax filing.